APY Calculator

Atal pension Yojana Calculator: Meaning and explanation

Atal Pension Yojana is a Central Government-backed pension scheme for citizens of India, especially those in the unorganized sector. It is also open to people employed in private sector. The Pension Funds Regulatory and Development Authority of India (PFRDA) manages the funds collected from the contributors. On the e has to contribute a fixed monthly, quarterly or half yearly till the age of 60. On attaining the age of 60 years one choose the pension of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000 or Rs. 5000, but the person has to contribute regularly based upon the pension one expects to receive after 60 years. The pension can be claimed by the spouse upon the death of the contributor or by the nominee after the death of both the contributor and spouse.

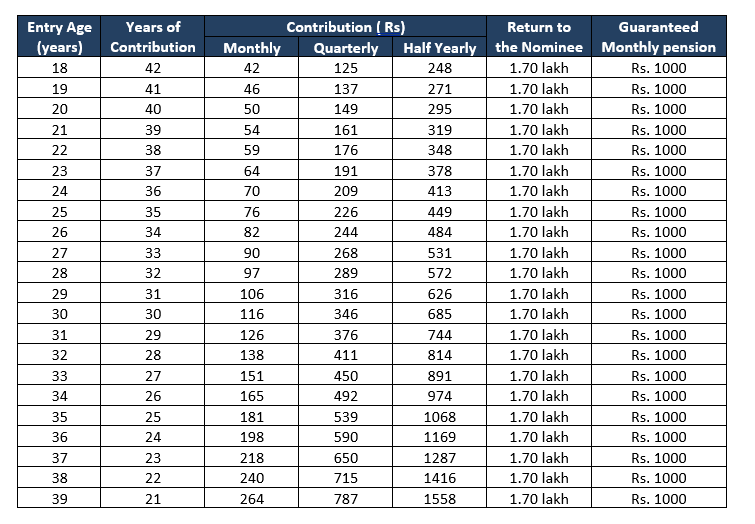

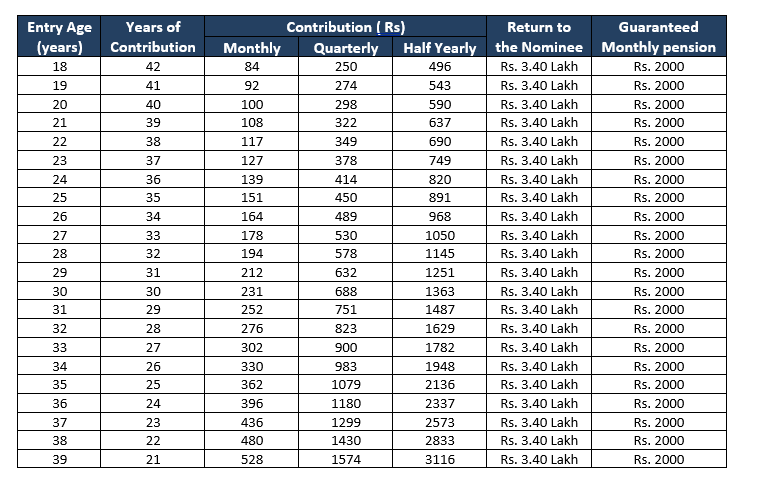

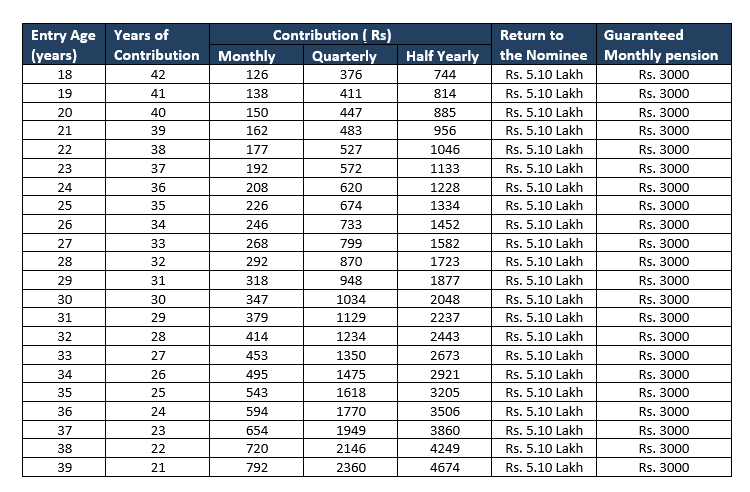

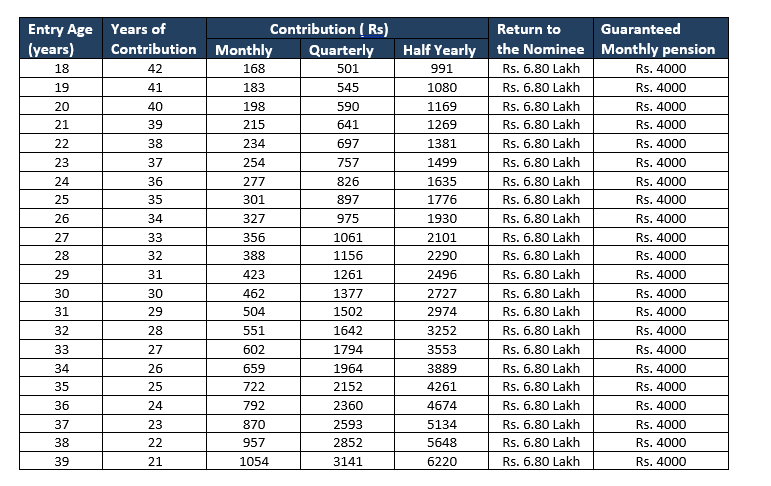

Atal Pension Yojana Contribution Calculator: Atal pension Yojana calculation tables

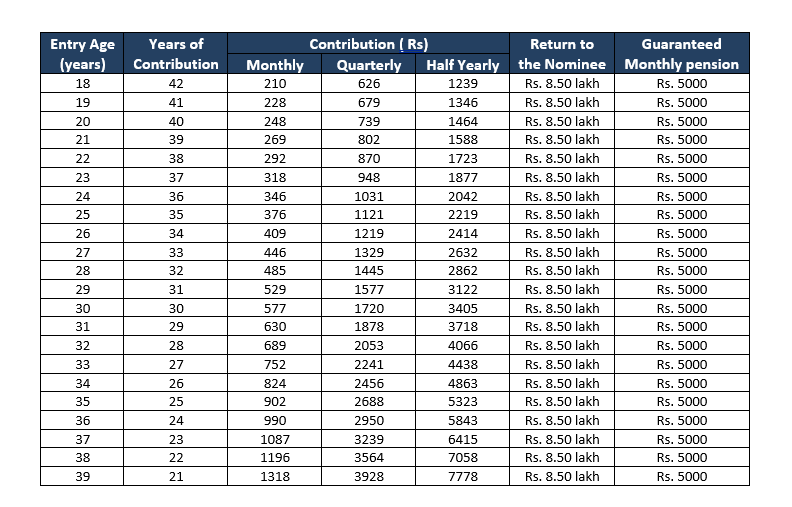

The Atal Pension Yojana calculation tables show the amount an individual is required to contribute monthly, quarterly, or half yearly to get a pension of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, and Rs. 5000. It also indicates the final amount the nominee would get in case of contributor’s death.

Atal Pension Yojana Calculation table for Guaranteed Minimum Monthly Pension of Rs. 1000

Atal Pension Yojana Calculation table for Guaranteed Minimum Monthly Pension of Rs. 2000

Atal Pension Yojana Calculation table for Guaranteed Minimum Monthly Pension of Rs. 3000

Atal Pension Yojana Calculation table for Guaranteed Minimum Monthly Pension of Rs. 4000

Atal Pension Yojana Calculation table for Guaranteed Minimum Monthly Pension of Rs. 5000

Key Details of Atal pension Yojana:

Eligibility: Any Indian Citizen with a minimum age of 18 years and maximum age of 40 years

Minimum and maximum period of Contribution: Minimum 20 years, maximum 39 years

Requirements to open an account: The aspiring subscriber must have a savings bank account, an Aadhaar number, and a mobile number

Where to open an APY account? :Any Nationalized or Private sector bank

How to open an APY account? Visit the bank branch where you have a savings bank account and fill out the APY application form or you can open an APY account online by using the net banking facility

Mode of Contribution: Auto debit facility of banks

Number of accounts: The subscriber can open only 1 account, multiple accounts are not permitted

Contribution amount change: Subscribers can increase or decrease the pension amount once a year

SMS Alerts: The subscriber receives periodic SMS alerts regarding PRAN, account balance, and contribution credits. A physical statement of account is received by the subscriber once a year.

Change in mode of payment: The subscriber can change the mode of payment (monthly/quarterly/half yearly) once a year.

Exit before the age of 60 years: The subscriber will be refunded only the contributions made by him along with accrued interest, after deducting account maintenance charges. If the customer has availed the Government co-contribution, then the Government co-contribution and accrued interest on it will not be refunded.

Death before the age of 60 years: The spouse of the contributor can continue the contributions in her name till the original subscriber would have attained the age of 60 years or she has the option to receive the entire accumulated corpus.

In case of default in contributions: A penalty will be levied as below

(a) Rs. 1 per month for contributions up to Rs. 100 per month

(b) Rs. 2 per month for contributions up to Rs. 101 to 500 per month

(c) Rs. 5 per month for contributions up to Rs. 501 to 1000 per month

(d) Rs. 10 per month for contributions beyond Rs. 1001

If no contributions are made then

- After 6 months your APY account will be frozen

- After 12 months your APY account will be deactivated.

Whats Your Wealth Quotient?

you will be surprised!!!!