CAGR Calculator

CAGR Is:

CAGR growth

CAGR stands for compound annual growth. It is an important tool used to determine how well an investment like a mutual fund or a business has performed in a competitive market. An investor can calculate how much an investment has returned per year on a compounded basis. The formula used to calculate CAGR is as under:

CAGR Formula:CAGR = (FV / PV)1 / n – 1

Where,

FV = Future Value of Investment

PV = Present Value of Investment

n = Time period in years

The below illustration shows how CAGR is calculated.

Let's say, an investor invests Rs 10,000 and it grows to Rs.10,0000 in 3 years. The CAGR calculation is as follows:

CAGR = (100000/10000)1 / 3 – 1

CAGR = 1.1544

CAGR percentage = CAGR x 100 = 1.1544 x 100 = 115.44 %

It means that investment has grown at an annual rate of 115.44% on a compounding basis.

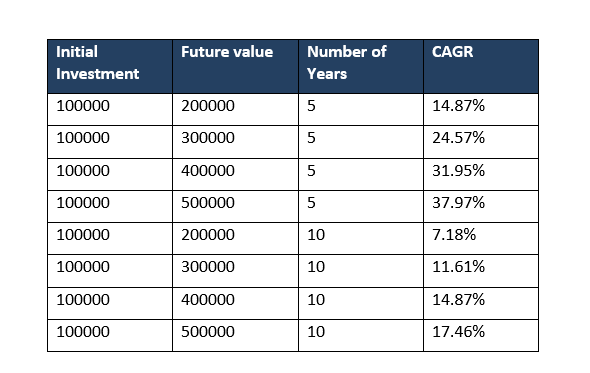

The below table better illustrates some examples of CAGR:

Limitations of CAGR

Limitations of CAGR

- CAGR doesn't take into consideration the volatility of your investment and calculates only the average percentage returns on a compounded basis. It implies that the growth rate of the investment was steady over a period of time. Returns on investment are volatile most of the time except for government instruments like fixed deposits, bonds, etc. So CAGR should not be taken as the only tool to measure returns from an investment.

- CAGR suitable only for only one-time investment. For SIP investments, the regular investment at various time intervals is not considered and only the beginning value is taken into account for the calculation of CAGR

- CAGR does not determine the risk-return reward of the investment. In the case of equity investments, Sharpe's Ratio and Treynor's Ratio are used to determine the risk-return reward of the investment.

Absolute return is the return on an investment over a given time period, expressed in percentage terms.

The formula used to calculate the absolute return for an investment is as under:

Absolute Return = (End Value – Beginning Value) / (Beginning Value) * 100

For example, an investment of Rs 1,00000 in December 2016 appreciated to Rs 1,80000 in May 2019. The absolute return is given as:

Absolute Return = (1,80000 – 1,00000) / (1,00000) = 80%

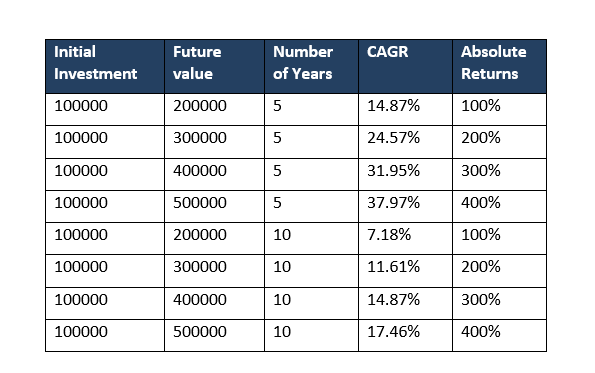

The below table better illustrates the difference between CAGR and absolute returns:

What are the benefits of the CAGR calculator?

What are the benefits of the CAGR calculator?

- CAGR calculator tells you about the performance of your investment or funds compared to other available options in the market

- It helps to know the relative growth of your company as compared to established leaders of your sector.

- It helps to know you if your business is growing or declining and to what extent this is happening.

The CAGR calculator is very simple to use and gives results instantly. Just put the investment amount, the future amount you expect, and the number of years you wish to invest. Just enter and you will get the instant result.