ELSS Calculator

ELSS calculations at a glance

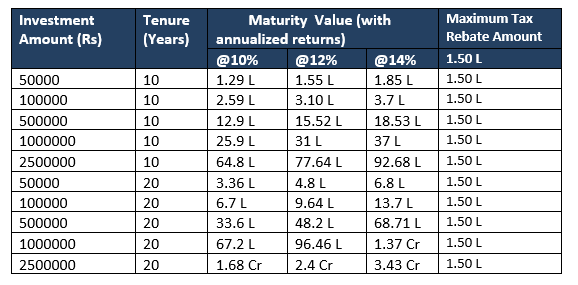

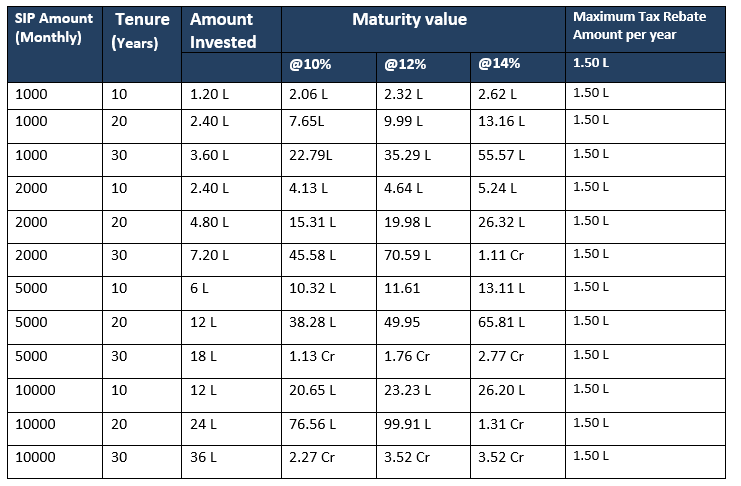

ELSS mutual funds help to generate wealth and also save tax. Investors have options of SIP mode or Lump sum investment mode. The below table gives an estimate of returns one can expect while investing in ELSS funds.

ELSS Calculator: One-Time Investment

ELSS Calculator: SIP Mode

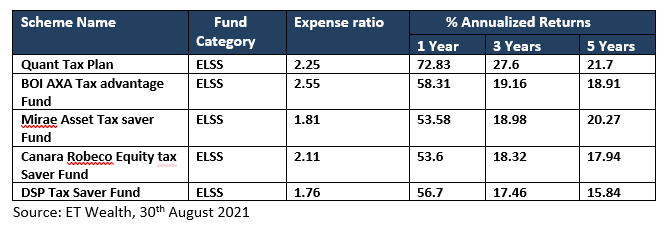

Best ELSS Funds to invest in 2022

Choosing top-performing ELSS mutual funds is the first step to achieving your goals with ELSS funds, for, a small difference in returns makes big difference over a period of time. The table below is a list of best-performing ELSS funds for the year 2022.

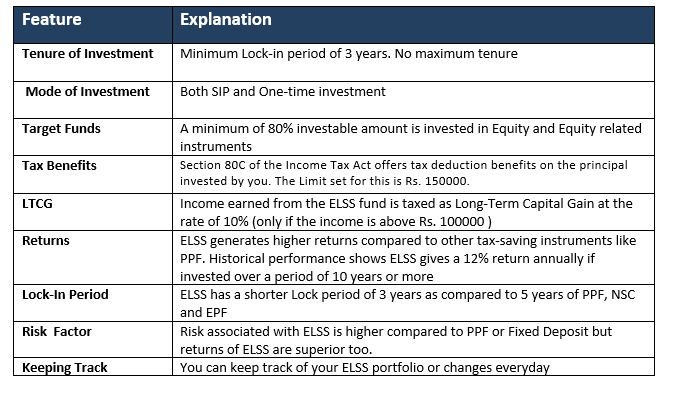

What is ELSS Fund? Why should you invest in ELSS?

ELSS stands for Equity Linked Savings Scheme which has a mandatory lock-in period of 3 years. A major portion of ELSS funds is invested in equity or equity-related instruments. They are also called tax saving schemes as they offer tax exemption of up to Rs. 150000 from your annual taxable income under Section 80C of the Income Tax Act. Investors basically turn to ELSS schemes to avail of tax benefits. If someone invests in ELSS funds, then you can avail tax exemption of the invested amount up to a limit of Rs. 150000 and the income that you earn under this scheme at the end of the three-year tenure will be considered as Long Term Capital Gain (LTCG) and will be taxed at 10% (only if the income is above Rs. 1 lakh).

Features of ELSS Funds

Frequently Asked Questions

How to use the ELSS calculator?

ELSS calculator is a tool that helps investors to estimate the returns on their investment in ELSS mutual funds, based on their mode of investment which is SIP or Lump sum. To estimate the maturity amount you have to put details such as mode of investment (SIP or Lump sum), tenure of investment, expected rate of return, and amount to be invested.

How can ELSS Calculator help you?

- With the ELSS calculator, you can easily estimate maturity amount

- It is fast and accurate

- You can easily compare SIP and One-time investment returns

- ELSS Calculator helps to make informed financial decisions

How does the ELSS calculator work?

For One Time investment ELSS Calculator uses the concept of future value and is based on the formula

Future value = Present Value (1 + r/100)^n, where

Present value = Amount Invested

r = Expected rate of return

n = Number of years amount is invested

For SIP based ELSS calculator formula is as under

SIP ELSS Calculator works on the principle of Compound Interest. The formula used in the calculation is

Maturity Amount = P × ( { [1 + I ] n – 1} / I ) × ( 1 + I )

Where:

P= Amount invested at regular intervals

n = Number of installments paid

i = Periodic rate of interest