NSC Calculator

Break-up of Maturity Amount

National Saving Certificate (NSC) calculator: Calculate the maturity amount based on your investment

NSC Calculator is an easy-to-use tool to calculate the maturity amount of your investment in a national saving Scheme for a given rate of interest. It is a small saving scheme backed by the Government of India for resident Indians

What is National Saving Certificate?

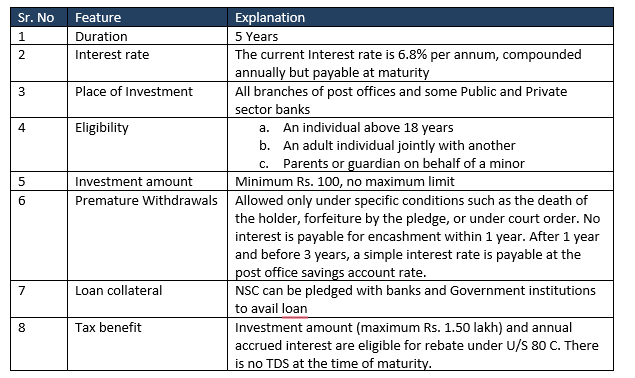

National Saving Certificate is one of the popular small saving schemes for taking tax benefits U/S 80C of the Income Tax Act. It fixed-income scheme with guaranteed returns. The current rate of interest is 6.8% (the Ministry of Finance announces the rate of Interest every quarter) and interest is compounded annually. NSC comes with a fixed tenure of 5 years. Investment amount (maximum Rs. 1.50 lakh) and annual accrued interest are eligible for rebate under U/S 80 C. There is no TDS at the time of maturity. The minimum investment amount is Rs. 100 with no maximum limit.

Previously 2 types of NSC were available VIII Issue and IX issue, but the IX issue is discontinued now, and currently, only the VIII issue is available. All details here pertain to the VIII issue.

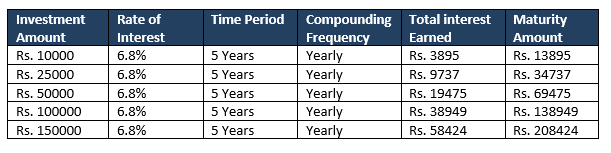

NSC Calculations at a glance

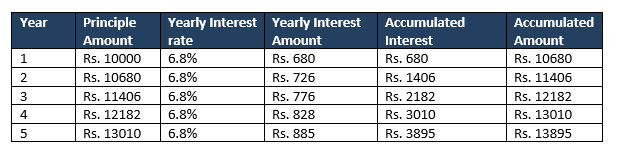

How to Calculate the NSC interest rate every year? Sample illustration

National Saving Certificate Key Features

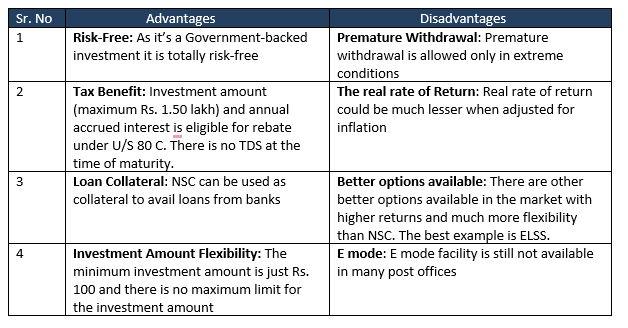

NSC advantages and Disadvantages

How to use the NSC calculator?

NSC calculator is an easy-to-use tool with generates results in just a fraction of a second. Just put your investment amount and rate of interest and you automatically get the maturity amount and the interest earned on your amount

How can NSC Calculator help you?

NSC calculator can help you in multiple ways as under

- NSC calculator helps you in financial planning. By knowing the maturity amount in advance one can plan his future finances well in advance

- NSC calculator is easy to use. Just put the amount you wish to invest in the calculator and you know the maturity amount and the interest earned.