SIP Calculator with Inflation

What is inflation? How inflation affects SIP Returns

What is Inflation?

Inflation is the general rise in the prices of most goods and services of daily use, such as food, consumer staples, housing, transport, recreation, etc. Inflation measures the average price change in a basket of commodities and services over a period of time. Inflation decreases the purchasing power of a unit of a country’s currency. Inflation is measured in percentages

How inflation affects SIP Returns:

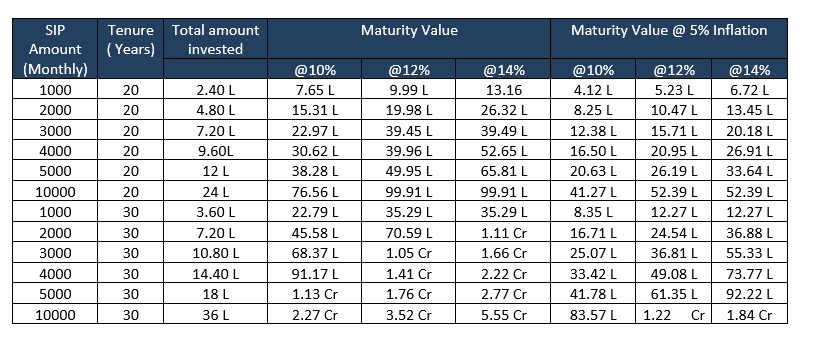

Though SIPs accumulate a decent amount of wealth over time, it gets affected by inflation and thus the real wealth reduces in value. If your SIPs earn an annual return of 12 % and the inflation rate for that year is 5% it implies that you actually earned a return of 7% (12%-5%= 7%). This is how the purchasing power of your money gets The below table shows the effect of inflation on your maturity value.

Historical inflation rates in India

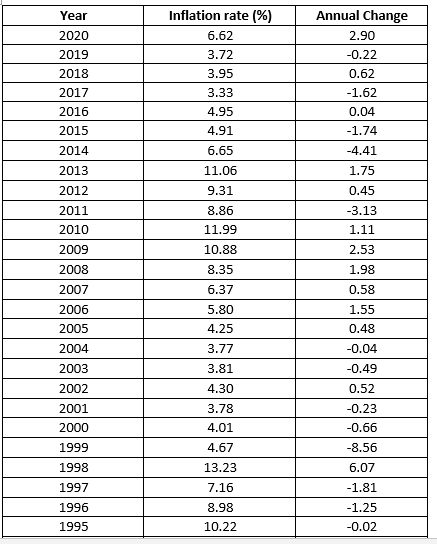

Inflation is measured by the consumer price index (CPI) and it reflects the annual percentage change in the cost to the average price of acquiring a basket of goods and services that may be fixed or changed at specified intervals, generally yearly. The below table shows how inflation has fared in India over a period of time.

Source: World Bank

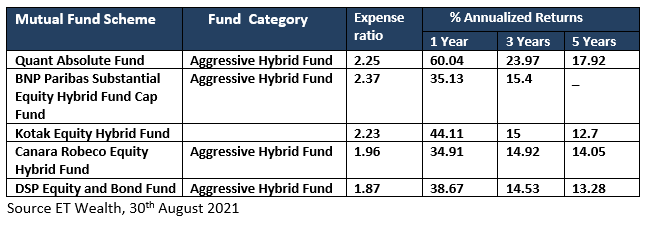

Best SIP Plans 2021 to beat Inflation and give superior returns

Choosing the right mutual fund for SIPs should be the primary task of an investor, as one should be investing for a longer period of time the wrong selection of mutual fund can make a huge difference in the maturity amount. Below is the list of top-performing mutual funds for SIP investment in India for the year 2021.

Frequently Asked Questions

How does the SIP calculator with Inflation work?

SIP Calculator works on the principle of Compound Interest. The formula used in the calculation is as under

Maturity Amount = P × ( { [1 + I ] n – 1} / I ) × ( 1 + I )

Where:

P= Amount you invest at regular intervals

n = Number of installments you have paid

i = Periodic rate of interest

If you invest Rs. 1000 for 12 months with periodic a rate of interest of 12% then in the above equation rate of interest becomes 12%/12 which equals 0.01.

Finally, the Inflation rate is adjusted in the formula accordingly.

How to reduce the inflation effect on your SIP Returns?

- Increase the SIP amount every year that is opting for Top up SIP. This will give you more returns compared to keeping the fixed amount throughout the investing period.

- Always choose the mutual fund that has existed in the market for many years and has consistently given superior returns.

- SIPs are meant for the longer term. Keep investing continuously for a maximum number of years. The compounding will always work in your favor.